The Future of Hong Kong Linked Exchange Rate

System: RMB or USD?

My Facebook Page: PageThe Glocal: The Glocal

Author: Dasein

Recently,

Sir David Li Kwok-po, the chairman of Bank of East Asia and former Legislative

Council Member (Constituency: Finance), has called for a review of Hong Kong

Linked Exchange Rate System before its 30th birthday. He has

expressed his opinions about the system in an interview conducted by Hong Kong

Economic Journal. He believed that Hong Kong dollar should link up with RMB instead

of USD in the future.

As

the same time, Norman Chan, the Chief Executive of Hong Kong Monetary Authority

(HKMA), stated that Hong Kong did not have right conditions for linking up with

RMB. Also, Dr. John Greenwood , who is well known as “father of Hong

Kong-dollar peg”, has shared similar points of view. Dr. Greenwood said Hong

Kong could link up with RMB if 4 conditions will be satisfied in the future. 1.

RMB should be freely traded and transferred. 2. RMB has become international

common reserve currency. 3. Mainland China has replaced the U.S. as global

economic leader. 4. Central Bank of China can use interest rate adjustment as primary

monetary policy.

In this article, I am going to show you why

Hong Kong should link up with USD instead of RMB.

Exchange

Rate and Finance

In

economics, the exchange rate is determined by the supply and demand of two

currencies. However, the supply and demand would be influenced by domestic

interest rate. Regulatory Institutions such as Federal

Reserves will adjust interest rate based on government needs and financial

situation. In general, low interest rate can boost economy and high interest

rate can press down inflation and hot money. Although interest rate is not the

only option for the institutions, it is one of the most important primary

monetary policy tools.

For

big economic entities, interest rate can be purely determined by domestic

economy. However, it is not easy for small economic entities to play this way,

because small economic entities do not want large variation of their exchange

rate. Therefore some of the small economies, such as Hong Kong, would fixing currency

exchange rate with big economic entities, such as the U.S..

Hong

Kong Linked Exchange Rate System

Hong

Kong Linked Exchange Rate System is pegging with USD for HKD: USD = 7.8:1. USD

is a large liquidity global currency with high stability, therefore this

pegging system has created a good investment and business environment for Hong

Kong.

In

order to make the arbitrage works for the pegging system, HKMA has a

USD 300 billion foreign reserve, mainly funded with USD assets. If HKD is going

to link with RMB, it is very likely for HKMA to short USD and long RMB as

foreign reserve in the future.

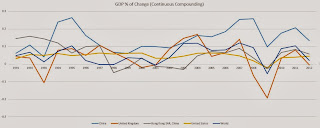

Number

Fact: Correlation of % of GDP Change

As

I have mentioned before, economy, interest rate, and exchange are closely

related. It is important for regulatory institutions to launch their own

monetary policies based on their needs. However, linked exchange rate will make

the domestic interest rate go with foreign interest rate. Hence, linked

exchange rate system can only be conducted for 2 economy system sharing similar

conditions. Otherwise, the domestic interest rate could be forced to go up in

economic downturn or vice versa.

To

make it simple, the GDP change of Hong Kong should be similar with linked

country. The consistency of GDP change

can make sure the same monetary policy is favourable to both economies.

(Picture 1 - % Change of GDP)

(Picture 2

– Net Difference of % Change of GDP between HK and respective region)

%

of GDP Change

|

Data: World Bank

Calculation: Author |

|

Average(91-12)

|

Average(00-12)

|

|

China

|

0.14333904

|

0.157174696

|

United Kingdom

|

0.039586119

|

0.037081148

|

Hong Kong SAR, China

|

0.055921184

|

0.035580766

|

United States

|

0.04560696

|

0.040197705

|

World

|

0.05383893

|

0.063902779

|

Mean Square Difference of GDP change (%)

|

||

Average (91-12)

|

Average(00-12)

|

|

China

|

0.014089588

|

0.016294639

|

United Kingdom

|

0.009804006

|

0.008256297

|

Hong Kong SAR, China

|

0

|

0

|

United States

|

0.003407349

|

0.001300086

|

World

|

0.004533891

|

0.002924684

|

In

the graphs and tables, we may conclude that China’s GDP change has not been

consistent with Hong Kong’s GDP change. However, it would be important to you

to understand the limitations of my analysis method.

1 China economy is reforming,

and it may lead China economy to be consistent with the rest of the world.

2 History may not tell future.

3 Hong Kong and the U.S. should be more

consistent because we are sharing similar monetary policy.

However, the data of the U.K. and the world can show us China is relatively not

consistent with Hong Kong.

4 Hong Kong is converging her industries.

Also, many industries in Hong Kong are now heavily depended on mainland China.

We may predict that Hong Kong and China will have a higher economic consistence

in the future.

To

conclude, Hong Kong and China could be more consistent in terms of % of GDP

change, but Hong Kong economy will dance in the same pace with other free

economies better instead of mainland China because of China’s financial

structure and unique regulations.

Number

Fact: Debt-to-GDP

Ratio

Choosing appropriate exchange rate

link is similar to buying stocks. We have to ensure the financial health of

linked country in order to avoid exchange rate crisis.

We

have already known that both the US and China are suffering from serious debt

issue. However, who is the better one?

According

to the average number of the data from CIA and IMF,

the US debt-GDP-ratio is about 80% in 2012 while China is 27%.[2]Although

the US is not in the top of the debt list, the debt of the US is in

historically high level. Dr. Anis Chowdhury and Mr. Iyanatul Islam from

The University of Western Sydney expressed their theory in “Is There an Optimal debt-to-GDP ratio?”[3],

they concluded that there is no optimal debt-to-GDP ratio yet in academic

researches. However, over 60% debt-to-GDP ratio is statistically high if we

look into global data.

(Picture 3

– Map of Debt-to-GDP ratio)

However,

the debt of China has not taken local government debt into account. In fact, many

organization have estimated China debt-to-GDP ratio (included local government

debt) from 45% to 78%. This large estimation interval suggests

that the debt issue in China is not clear enough, it is possible that China is

in debt as much as the US. More importantly, it is hard to believe the central

government of China can handle the problem if no one can tell an accurate

number of local government’s debt.

(Picture 4 – Estimation of

China’s debt)

Also,

even the central government of China suspects that the GDP of China is

generally overestimated. Some of the news have discovered the administration of

China does not believe in their GDP value but the consumption of electricity, they

believed that the consumption of electricity was directly proportional to the

real productivity of respective area. If the GDP of China is overestimated, it

is possible for China to have a higher debt ratio than the US.

As

I have mentioned, would you buy a stock without knowing its debt issue?

Financial

Stability: RMB and USD

Financial

stability is owning a high weigh in determining exchange rate,

however, financial stability is affected by many factors. In general, financial

system with larger quantity of currency issued will be more stable from

external effect.

Nowadays,

USD is used to trade in different market, therefore the quantity of issued USD

is very large. Therefore, USD is more stable from external

effect relative to other currencies. We may conclude that linking with USD is a

better option because we are looking for exchange rate stability in the first

place.

Also,

RMB cannot be transfer and trade without restrictions, this would limit the attractiveness

of China market to foreign investors. This makes RMB ever worse for being a

linked currency.

Foreign

Reserve: Liquidity Risk, Credit Risk and Inflation Risk

HKMA

have to bear liquidity risk, credit risk and inflation risk of linked country

because HKMA must hold foreign currency in reserve.

With reference to current regulation, RMB has

worse liquidity than USD because there are many restrictions for transferring

and trading RMB.

Also, the credit risk of RMB bond may

directly caurse credit crisis in China. This may lead to hyperinflation if the

default risk is not controlled. HKMA’s RMB reserve would be greatly affected if

there is a hyperinflation in mainland China.

It is basically impossible for RMB to be a

better option for linked currency if China is using planned economy and

exchange rate control. [4] This is why Dr. John Greenwood has given 4

conditions for RMB to achieve before HKD links it.

Pillar

of Financial Hub:

Exchange Rate Transparency and Market Oriented

As

a financial hub, it is important for Hong Kong to have high exchange rate

transparency. Market oriented financial system and high transparency can let investors

to estimate their risk and market trend. These 2 conditions are very important

in quantitative financial and risk management models.

If

HKD links with RMB, the transparency of Hong Kong exchange rate

will be greatly harmed because RMB cannot be freely traded.

Pillar

of Financial Hub:

Trust, Stability and Administrative transparency

If HKD and RMB are

linked, Hong Kong financial system will be affected by the lack of trust to

mainland China, the political stability of China and China’s administrative

transparency.

It

is hard to make subjective judgement about 2 political systems, the US and

China. However, I believe the emigration history of Hong Kong can tell how Hong

Konger believe in mainland China.

Pillar

of Financial Hub:

Financial

System

If

HKD and RMB are linked, this is no doubt that Hong Kong financial service will

merge with mainland China. It is hard to believe Hong Kong financial industry can

maintain high standard, because corruption and financial regulation

incompleteness are well known in mainland China.

It

would be no harm to merge with mainland China if and only if they are having

similar financial regulatory standard to Hong Kong.

After

Linking:

Hong

Kong and Shanghai

If

HKD and RMB are linked, the competitive advantages of Hong Kong will diminish.

The

first reason is worsening financial standard; Also, Hong Kong is less

attractive for mainland investors for avoiding risk;

Besides, it is more risky for foreign investors taking part in Hong Kong’s

financial activities.

Compare

to China supported Qianhai area and Shanghai,

Hong Kong has given up our own advantages but not gaining “Chinese background”

advantages. If you are the CEO of Goldman Sachs, do you think you will be

interested in Hong Kong?

After

Linking:

Chinese Clients Only

If HKD and RMB are linked, the risk of having

business between Hong Kong and foreign country is higher,

but less for trading with mainland China because of the fixed exchange rate. Hong

Kong will be a so-called financial hub with mainly mainland Chinese clients.

Huge proportion of Chinese clients is not

only a diversity problem, but also a political problem. I am sure this point

can be easily understand if we looking into the independency of Hong Kong

policy.

After

Linking: Foreign Inflation

The

value of HKD would not constantly go up after linking with RMB. Hong Kong

people have to deal with inflation even linking up with RMB.

The

Hong Kong monetary policy have to be made based on Hong Kong’s financial needs

but not administrative needs. Link Exchange Rate System should not be used to

relieve the administrative pressure from inflation.

In

fact, linking up with RMB is not an only option if we want to deal with the

inflation. Adjusting the fixed exchange rate with USD can do the job, questions

should be asked why inflation of Hong Kong is raised as a reason for linking up

HKD with RMB.

Benefit

for Linking up with RMB

In

a short run, the CPI of Hong Kong would be lower, this is certainly a good news

for Hong Kong government. For the businessmen, their China business could be

benefited from diminished Hong Kong financial market because they are usually

having good relationship with China administration.

For

general public, the price of China goods would be stabilized but not the

foreign goods. It is hard to tell if stable IPhone price is more important than

Chinese water price. It is all about your social status and consumption habit.

The

Future of RMB: Prof Chen Zhiwu: China Model Never Exists

This

is a fact that RMB will stop raising someday, also it is not

known if China can continuous her development. The proportion of consumption of

China’s GDP is going down recently [5], her GDP is leaded by investment (46%),

this is not common in neither developing nor developed countries. Without the

strong support of consumption, many economists are worrying about China’s

GDP growth. Furthermore, China is now famous for “reconstruction economy”, China

local government are looking for an opportunity for reconstruction, so that

they can have GDP from infrastructure investment. Although some people believe

that China is no longer needed to keep 8% economy growth [6],

people are generally worrying about the slowing down economy growth in China.

In

fact, some of the China local GDP was raising while the electricity consumption

was going down. The central government of China is having questions for local government

financial health.

The professor Zhiwu Chen, from

Yale School of Management, was questioning the future of China’s economy in his

book “China Model Never Exists”. He

did not believe that the fast growing China economy would be sustainable

without true economic and political reform.

It

is clear that it is not wise to link up with RMB without further observation

and discussion.

Conclusion

Hong

Kong monetary policy should be made based on Hong Kong’s financial needs. Today,

Hong Kong and China are having a complicated financial relationship, hence, it

is also a better idea for us to listen the opinions from the both side.

In

my points of view, linking with RMB is not a mature option yet. It would be a

possible option if China makes serious changes in financial system and

political system.

Picture Source:

[Picture 1, 2]: by Author. (Data: World Bank)

[Picture 4]: Richard Silk, How Big is China’s debt? The Best Guess, The Wall Street Journal,

Viewed 15th Oct, 2013, http://blogs.wsj.com/chinarealtime/2013/07/30/how-big-is-chinas-debt-here-are-the-best-guesses/

Reference:

[1]: GPD History: The World Bank, Viewed 15th

Oct, 2013, http://data.worldbank.org/indicator/NY.GDP.MKTP.CD

[2]: Debt to GDP Ratio, Viewed 16th

Oct, 2013, http://en.wikipedia.org/wiki/List_of_countries_by_public_debt

[3]: Anis Chowdhury and Lyanatul Lslam, Is There an Optimal debt-to-GDP ratio?,

Viewed 16th Oct, 2013, http://www.voxeu.org/debates/commentaries/there-optimal-debt-gdp-ratio

[4]: David Pauly, China’s State-Planned Economy is Doomed to Flop, Bloomberg, Viewed

16th Oct, 2013, http://www.bloomberg.com/news/2010-11-23/china-s-state-planned-economy-is-doomed-to-flop-david-pauly.html

[5]: Duncan Freeman, China’s Consumption to the Rescue?, Viewed 16th Oct,

2013, http://www.understandingchina.eu/Chinaideascommunity/LatestresearchonChina/tabid/887/PostID/2754/Default.aspx

[6]: Shaun Rein, Viewpoint: Why 8% may not be the magic number for China, BBC News

Business, Viewed 16th Oct, 2013, http://www.bbc.co.uk/news/business-21055964

沒有留言:

張貼留言